3D Printing vs. CNC Machining: The Difference

Have you wondered what the differences between 3D printing and CNC machining are?

According to Industry Today:

3D Printing vs. CNC Machining: How do They Differ?

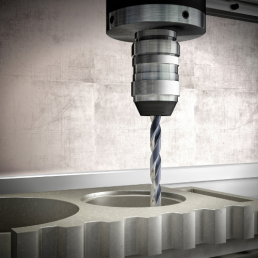

When it comes to choosing a manufacturing or prototyping technology, the two options most businesses have to choose between are 3D printing and CNC machining. There is no single ‘right’ option. As this guide will show, the ideal technology to use depends on a number of factors.

Materials being used

An oversimplified description of 3D printing technology is to imagine a normal printer, only instead of ink/toner; it uses molten solids (usually plastics) to create 3D objects. This means that even high-end industrial 3D printers cannot work with materials with very high melting points – such as most metals. CNC machining, on the other hand, works well with a variety of materials including metals, wood, and plastics. The raw materials required in the manufacture of a product determine the ideal technology to be utilized.

Cost

The most important variable to consider when carrying out a cost comparison between 3D printing and CNC machining is the order quantity. Generally, 3D printing becomes a cheaper option when one needs to manufacture smaller quantities – usually less than 50. The fact that it is usually the faster option makes it ideal for rapid prototyping. When working with larger orders, CNC machining is usually more cost-effective. Since CNC machining utilizes an assembly line approach with each component being created by different machinery, it is the faster option for mass production.

Sustainability

Sustainability is all about avoiding wastage, especially when it comes to valuable resources. 3D printing and CNC machining use opposing approaches in their individual manufacturing processes. 3D machining uses additive manufacturing, in which the raw materials are added layer by layer to create the designed object. There is very little in terms of wastage since the materials are being used to create the desired product. CNC machining uses subtractive manufacturing, where the manufacturing process begins with a solid block of material which is then cut, carved and shaped to form the desired object. This creates a lot of wastage, most of which may not be recyclable. Therefore, 3D printing is the most sustainable option.

Quality and Precision

Both technologies can develop high-quality products, but 3D printing has some limits that may affect the durability of the finished product. Even with large industrial 3D printers, there will always be size limitations regarding the thickness of the produced material and the volume. 3D printing also mostly utilizes plastics and other raw materials with low melting points which might not deliver the desired quality levels for some products. These limitations do not exist with CNC machining. However, CNC machining cannot replicate unusual geometric designs with the accuracy and precision that 3D printing can deliver.

Global Forging Market Expected to Reach USD 95,843.4 Million by 2028

Some reports have found the forging market is set to see an increase in the coming years.

According to PR Newswire:

According to a recent market study published by Growth Market Reports titled, "Global Forging Market by Type (Impression die forging, Cold forging, Open die forging, Seamless rolled ring forging), by Metals/Raw Materials (Aluminum, Magnesium, Copper/Brass/Bronze, Micro alloy, Special steel alloy, Carbon and Stainless Steel, Nickel based, Titanium, Refractory metals, Zirconium) by Application (Automotive [Light Commercial Vehicles, Medium & Heavy Commercial Vehicles], Aerospace, Oil & Gas, Agriculture, Mining, Construction, Power Generation, Machinery, Hydraulic & other Machinery, Ordnance, Others), and by Region : Size, Share, Trends and opportunity Analysis, 2018-2028", the market was valued at USD 71,027.8 Million in 2019 and is expected to grow at a healthy growth rate of 4.8% by the year 2027. The forging market is anticipated to grow significantly during forecast period due to rise in demand for new an advanced part from the manufacturing of automobiles, aircrafts, shipbuilding, as well as construction, agricultural tools. Forged parts are preferred in many applications for their strength and sturdiness.

Key Market Players Profiled in the Report

Bharat Forge Limited

ELLWOOD Group Inc

Kalyani Forge Ltd.

KITZ Corporation

Precision Castparts Corp

Nippon Steel & Sumitomo Metal

Thyssenkrupp AG

VDM Metals GmbH

Allegheny Technologies Incorporated

Precision Castparts Corp

American Axle & Manufacturing, Inc

Aubert & Duval S.A

Arconic Inc

Schuler AG

Sypris Solutions, Inc

Lucchini RS S.p.A

The report covers comprehensive data on emerging trends, market drivers, growth opportunities, and restraints that can change the market dynamics of the industry. It provides an in-depth analysis of the market segments which include products, applications, and competitor analysis.

This report also includes a complete analysis of industry players that cover their latest developments, product portfolio, pricing, mergers, acquisitions, and collaborations. Moreover, it provides crucial strategies that are helping them to expand their market share.

Highlights on the segments of the Forging Market

Increasing number of automotive, aircraft manufacturing units also the rising construction activities has boosted the demand for forged parts. Asia Pacific region to witness substantial growth during forecast period in terms of demand for forged parts. The boom in automotive and construction industry owing to the rapidly growing population in the region is prime factor driving the market growth.

On the basis of type, the global forging market is segmented into impression die forging, cold forging, open die forging, and seamless rolled ring forging. The impression-die forging segment held a substantial share of the market in 2019, and is anticipated to expand at significant CAGR during the forecast period.

Impression die forging, also known as closed die forging, is widely used, as it can produce complex designs. The number of dyes required for closed die or impression die forging depends on the complexity of the design.

On the basis of metals/raw materials, the global forging market is segregated into aluminum, magnesium, copper/brass/bronze, micro alloy, special steel alloy, carbon and stainless steel, nickel based, titanium, refractory metals, zirconium. The carbon and stainless-steel segment held a substantial share of the market in 2019, and is anticipated to expand at significant CAGR during the forecast period.

Carbon and stainless steel are known for its strength and corrosion free properties. These metals are used for applications such as kitchen equipment and equipment related to food services.

On the basis of applications, the global forging market is divided into automotive and others. The automotive segment is further divided into light commercial vehicles (LCVs) and medium & heavy commercial vehicles (MHVs). The others segment includes aerospace, oil & gas, agriculture, mining, construction, power generation, machinery, hydraulic & other machinery, ordnance, and others.

The automotive segment held a substantial share of the market in 2019. Moreover, the medium & heavy commercial vehicles sub-segment held a key share of the segment. The medium & heavy commercial vehicles segment is anticipated to expand at a significant CAGR during the forecast period.

In terms of regions, the global Forging market is segregated into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Asia Pacific is expected to remain an attractive region of the market due to growing technological advancements in automobile and other industries in the region.

The market in Asia Pacific is projected to grow due to significant growth in the number of automobile industry in the region. Moreover, growing agriculture and hydraulic machinery industries are expected to boost the forging market in the region. The market in North America is expected to grow at a substantial pace due to rising ordnance and automobile industry in the region. Furthermore, Europe is expected to hold a significant share of the market during the forecast period.

Key Takeaways from the Study:

The market in the Asia Pacific is projected to grow significantly owing to the growth in number of automotive and construction companies in the region.

The automotive industry itself holds a major chunk of the market. In 2019, the automotive industry holds 65.30% value share of the total forging market

Impression die forging which also referred to as closed-die forging, holds majority of the market (4.3%) in value terms in 2019 owing to its high usage in automotive industries as well as the aircraft, aerospace and defense, railroad, mining etc. Impression die forging is widely used, as it can produce complex designs. The number of dyes required for closed die or impression die forging depends on the complexity of the design.

the carbon and stainless-steel segment held a substantial share of the market in 2019, and is anticipated to expand at significant CAGR during the forecast period.

Reducing CNC Machining Costs

With tighter budgets, it's vital to find ways to reduce your CNC machining costs.

According to Industry Today:

CNC machining can be the perfect manufacturing process for mechanical engineers that want sturdy and accurate parts, but CNC services can also be expensive. One of the reasons CNC machining becomes more expensive is machining time, which can cost more than materials and finishes. As a result, one of the best ways to reduce machining costs is to reduce machining time. 3D Hubs has a powerful platform that allows engineers to upload designs and assess weaknesses before designs go into production. Here are some tips to reduce those CNC machining costs.

Thin walls can increase production costs for a couple of reasons. Anything less than the standard thickness (0.8mm for metal, 1.5mm for plastic) will usually require different tools. Not only do thin walls potentially compromise the structural integrity of the part, but they can be prone to breaking during the manufacturing process. Taking extra care around these thin walls can increase production time, driving costs up.

Wherever possible, deep cavities in designs should be avoided. As a general rule, the more material that needs to be removed, the longer the production time. Not only do cavities mean large sections of material, but they also may require special tools. 3D Hubs has the technology to make just about any adjustments needed, but drilling certain depths will cost more. To limit costs, all cavities should have a depth of no more than 4 times their length.

Sharp corners can be costly with CNC machining. CNC tools have a cylindrical shape, and will, therefore, leave a rounded radius. Smaller tools can create smaller curves, but require more passes, which means more time and money. To keep costs down, the same radius can be used in all corners, and a radius should be at least 1/3 of the depth of the cavity.

Long threads can increase production time with special tools, and the end result likely won’t make the part any stronger. At maximum, the tread depth should be no more than 3 times the diameter. In the same realm, non-standard hole sizes with deeper lengths will also require special tools and production time.

Machine setups take time and often manual labor, which will usually cost more money, so minimizing the setup time can help engineers avoid larger costs. Designing parts that don’t require rotation and splitting them up so that they can be manufactured all in one setup and assembled later can make a huge difference in final costs.

Lastly, engineers can reduce costs by removing small details like lettering, and taking extra care when considering production material. Some materials can be machined quickly, but others will require twice as much time. Unless specific material is required, it’s worthwhile to consider other options.

3D Hubs can help engineers interested in CNC machining services with their designs and cost concerns quickly and easily. Using the 3D Hubs online platform, engineers can upload designs, receive feedback, and get a CNC quote within seconds. With this feedback, it’s easier than ever to make adjustments before going into production.

Why use forgings and where are they used?

Have you wondered why and where forgings are used? Consider this.

According to Forging.org:

What is forging?

Forging is manufacturing process where metal is pressed, pounded or squeezed under great pressure into high strength parts known as forgings. The process is normally (but not always) performed hot by preheating the metal to a desired temperature before it is worked. It is important to note that the forging process is entirely different from the casting (or foundry) process, as metal used to make forged parts is never melted and poured (as in the casting process).

Why use forgings and where are they used?

The forging process can create parts that are stronger than those manufactured by any other metalworking process. This is why forgings are almost always used where reliability and human safety are critical. But you'll rarely see forgings, as they are normally component parts contained inside assembled items such a airplanes, automobiles, tractors, ships, oil drilling equipment, engines, missiles and all kinds of capital equipment - to name a few.

Who buys forgings?

Forged parts vary in size, shape and sophistication - from the hammer and wrench in your toolbox to close tolerance precision components in the Boeing 747 and NASA space shuttle. In fact, over 18,000 forgings are contained in a 747. Some of the largest customer markets include: aerospace, national defense, automotive, and agriculture, construction, mining, material handling, and general industrial equipment. Even the dies themselves that make forgings (and other metal and plastic parts) are forged.

How big is the forging industry?

The forging industry is composed of those plants that;

a) make parts to order for customers (referred to as custom forgings);

b) make parts for their own company's internal use (referred to as captive forgings); or

c) make standard parts for resale (referred to as catalog forgings).

The largest sector - custom forging - accounts for over $6 billion dollars in sales annually. These custom forgings are produced by about 250 forging companies in approximately 300 plants across the U.S., Canada and Mexico.

How many people are employed by the forging industry?

Approximately 45,000 people from coast to coast are employed by the forging industry in the United States and Canada. Because the modern forging process is capital intensive (requiring an abundance of heavy equipment for manufacture and the people to run and maintain it), most forging plants are small businesses which generally employ between 50 to 500 employees each, with a few larger facilities employing over 1000 people.

What metals are forged?

Just about any metal can be forged. However, some of the most common metals include: carbon, alloy and stainless steels; very hard tool steels; aluminum; titanium; brass and copper; and high-temperature alloys which contain cobalt, nickel or molybdenum. Each metal has distinct strength or weight characteristics that best apply to specific parts as determined by the customer.

What kind of equipment is used to make forgings?

Although the styles and drive systems vary widely, a forging can be produced on any of the following pieces of equipment.

Hammers with a driving force of up to 50,000 pounds, pound the metal into shape with controlled high pressure impact blows.

Presses with a driving force of up to 50,000 tons, squeeze the metal into shape vertically with controlled high pressure.

Upsetters are basically forging presses used horizontally for a forging process known as "upsetting".

Ring Rollers turn a hollow round piece of metal under extreme pressure against a rotating roll, thereby squeezing out a one-piece ring (with no welding required).

Investing in CNC Machining

Curious how CNC machining could add to your ROI? Check this out.

According to Industry Today:

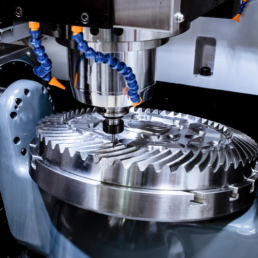

Computer Numerical Control machining is a relatively new type of machining that utilizes automation and computer controls to allow for much more precise machining than has previously been attainable when using an automated process. CNC machines are much more expensive than their conventional counterparts, but they have proven themselves to be stellar investments, rapidly earning their owners a return on their money.

How it Works

A CNC machine can be pretty much any type of industrial manufacturing machine – a lathe, a welder, a sheet metal stamper, it doesn’t really matter. What makes a CNC manufacturing special is the presence of an onboard computer that controls the movements of the machine. In the case of industrial machines, these computers will generally take the form of an onboard controller. However, hobbyist machines can be attached to a PC or laptop, which can act as a CNC.

CNC machines are able to move through several axes, enabling them to manipulate pieces much more precisely than conventional machines allow for. However, the level of precision depends very much on the specific machine in question with older machines being less capable than newer ones. Some modern CNC machines utilize robot arms that are able to move through multiple axes.

Also, while the best CNC machines will enable some very precise manufacturing – these are known as Swiss CNC machines – most CNC machines are chosen for their automation benefits than for their ability to tackle ultra-precise work. Manufacturers who don’t buy their own CNC machines outright are increasingly seeking out CNC machining services from other manufacturers who do have access to the machines.

Take Rapid Direct as an example. Their website shows the full range of CNC machining services that they offer to customers. China’s economy is largely built on its massive manufacturing capacity, so it’s hardly surprising to see CNC machining china taking off. Rapid Direct operates China’s largest manufacturing networks for CNC manufacturing and is able to provide CNC manufacturing, CNC milling services, CNC prototyping, CNC turning services, and many more.

Automation

Because CNC machining is automated, there is no need for constant human oversight. This enables manufacturers to significantly reduce their overheads by reducing the need to pay people to perform quality control monitoring. With high-quality CNC machines, manufacturers can rely on them to complete even complex routines quickly and without issue.

Businesses that can’t afford to buy their own high-end CNC equipment can still significantly reduce their manufacturing costs by engaging the services of manufacturers who are able to offer online CNC services. Not only is CNC machining often a cheaper process, but it is also a safer process as you don’t need to worry about humans being on the assembly line. Furthermore, machines will work very long hours without making many complaints, they don’t need to take breaks as people do. This means that automated CNC machining can continue even when everyone has gone home.

Replication

After automation, the next big advantage of CNC machining over traditional methods is that CNC machining enables easy replication. Not only are CNC processes automated and don’t require any human intervention, but they also enable for easy replication – producing the exact same thing over and over again.

While there are lots of manufacturers who can replicate the same object over and over, different processes will have different tolerances and error rates. A high-end CNC machine will reliably reproduce the same object over and over again with no perceptible variations between them, this is vital for the most precisely machined products.

Indeed, we live in an age of modular components and replaceable parts. Technologies like 3D printing and CNC machining are enabling us to produce precisely crafted interchangeable parts. A spare part for a car or bike, for example, is no good unless it can be relied upon to fit in place every single time on every single vehicle of that model.

Flexibility

Just as a skilled human can learn to machine any part, no matter how precise, if they are willing to learn how, we can program CNC machines to perform specific and precise routines. This means that a routine can be changed a little bit in order to correct a small issue, or completely rewritten to produce an entirely new product – it depends entirely on the item in question.

All that is needed for a CNC machine to produce a new product is for the programming to be slightly adjusted. This is much easier than equipping a machine with a completely new part, or even bringing in new equipment entirely for the sake of slight design alterations.

CNC machining has opened the door to cheaper and more reliable machining for businesses of all sizes. Businesses who aren’t yet able to invest in their own CNC machines can still avail themselves of the benefits by hiring CNC machining services online.

Metal Forging Market Size, Demand, Upcoming Trends and Revenue Analysis

Consider this look into the future of the metal forging industry.

According to EIN News:

The global Metal Forging market is forecast to reach USD 141.62 Billion by 2027, according to a new report by Reports and Data. The market is witnessing a surge an increased demand from the automotive industry due to its durability, strength, and reliability of forged components. However, alternative manufacturing processes for components, explicitly casting, will hamper the demand of the market.

Rapid urbanization has changed the lifestyle of the people and, in turn, has increased the prevalence of aerospace and automotive sectors over a broad aspect, thus, augmenting the demand for the market product. The limitations of metal forging, which include brittle metals that cannot be forged and is not apt for the complex shaping of the components, thereby gives rise to the need in the market to look for alternative options that will be hindering the growth of metal forging market.

The advent of the use of metal forging supported by the Ministry of Heavy Industries & Public Enterprises of the Indian government, as the forging market in India, is the key contributor to the overall manufacturing sector, thus creating a demand of the product in the market. Moreover, other nations such as China, Europe, and the United States are also supported by their respective government, which help them to withhold their position in the market and raise the potential to increase expenditure in the metal forging industry. The United States has initiated new anti-dumping duty and countervailing duty investigations to determine whether the forged steel fittings from countries like India and Korea are being dumped there and to find out whether producers in India are receiving unfair subsidies. There are around 45 subsidy programs alleged for India, which includes allegations that the Government of India provides exported subsidies, as well as subsidized financing, land, steel, and other raw materials. According to studies, The Asia Pacific region forecasted to grow with the highest growth rate owing to the increase in the use of metal forging...

Further key findings from the report suggest

Based on raw materials, carbon Steel is expected to grow with a CAGR of 6.7% in the forecast period, owing to its fundamental characteristics, which include efficiency, availability, and cost, thereby making it appropriate to use for a variety of applications.

The growth of the automotive sector has arisen the need for production of close net shapes with minimal maintenance over large production runs, driving the demand for the Metal Forging market. The open-die forging held a market share of over 22.0% in 2019 and is likely to grow at a rate of 7.3% in the forecast period.

The Automotive sector is the major contributor to the Metal Forging market, which was USD 28.75 billion in 2017 and is forecasted to grow at a rate of 7.1% in the period 2020-2027. The construction sector of the Asia Pacific region is estimated to grow at the fastest rate of 8.3% in the forecast period.

The Asia Pacific dominated the market for Metal Forging. The consistent focus of the region on cost-effective and innovative procedures adopted in the area is driving the market. According to studies, the Asia Pacific region holds approximately 58.81% of the Metal Forging market, followed by Europe, which contains around 20.6% market by area in the year 2019.

For the purpose of this report, Reports and Data have segmented into the global Metal Forging market on the basis of raw materials, type, application, and region:

Raw Materials Outlook (Revenue, USD Billion; 2017-2027)

Carbon Steel

Alloy Steel

Aluminum

Magnesium

Stainless Steel

Titanium

Others

Type Outlook (Revenue, USD Billion; 2017-2027)

Close-Die Forging

Open-Die Forging

Ring Rolling Forging

Upset Forging

Precision Forging

Application Outlook (Revenue, USD Billion; 2017-2027)

Automotive

Aerospace

Oil & Gas

Construction

Agriculture

Others

The research study includes an in-depth analysis of the market using advanced research methodologies such as SWOT analysis and Porter’s Five Forces analysis. The report further explores the key business players along with their in-depth profiling, product portfolio, and strategic business decisions. The report has been formulated through extensive primary and secondary research and further validated by analysts, industry experts, and market professionals. The report also sheds light on the recent mergers and acquisitions, joint ventures, collaborations, partnerships, and product launches, among others.

Digital Transformation Paving the Way for Manufacturing

Moving toward a more digitized systems is vital for manufacturers to succeed in the future.

According to Industry Today:

While the pandemic forced many manufacturing companies to quickly pivot to address short-term problems, planning for the long term — and moving away from traditional legacy systems in favor of digital transformation — has become a key priority within the manufacturing industry.

In fact, a study by Fictivi found 95% of manufacturing industry leaders agree that digital transformation is essential to their company’s future success.

Legacy systems are often outdated and not integrated into the other solutions businesses use. These legacy systems — which include operating systems, ERPs, CRMs, hardware, and network infrastructure — create a barrier to more efficient operations.

COVID-19 accelerated the conversion of digital ideas into high-priority strategies, helping the manufacturing industry build more efficient, resilient and greener supply chains. Companies must keep that digital transformation momentum going, developing long-term strategies to implement automation into their workflows now, because if you haven’t already done it, you’re already significantly behind your competition.

A critical step to achieving that goal? Moving away from aging legacy systems that are now obsolete. Automation platforms can close the automation gap for complex B2B transactions by creating resilient, scalable operations, reducing operational costs, and cultivating frictionless relationships with suppliers and customers.

Legacy systems erode your business

Legacy systems were built in the past to address different customer mindsets and expectations from a different time. These legacy systems won’t — and can’t — meet customer expectations of today or the future. By continuing to use legacy systems, businesses risk losing customers to competitors who’ve committed to evolving by using modern tools to better serve their customers, drive operational excellence and grow their top and bottom lines.

Outdated infrastructure can’t keep up with modern solutions’ demands. It creates bottlenecks for processes and operating capacity within the manufacturing industry. These systems erode business value, and using them indefinitely is an invitation for disaster.

Legacy systems harm businesses by:

Creating security risks. Legacy systems invite malware and security breaches because updating patches or security capabilities is challenging. An inability to keep up with updates leads to noncompliance with security standards, leaving businesses vulnerable to cyberattacks.

Leading to dysfunctional workflows and processes. Outdated tech incapable of working with newer technology forces companies to work within its constraints, like finding compatible browsers, operating systems and plugins that work with its more limited capabilities.

Requiring high maintenance and driving up operational costs. Because they’re older, legacy systems are expensive to maintain. Parts become difficult to source. Finding a qualified employee to manage it becomes more difficult. And antiquated software requires more expensive consultants to update, modify or repair.

Creating compatibility, integration and scalability issues with new systems. Regardless of your system’s age, it must integrate with the apps you need to run your business. Newer and more flexible digital systems are designed to handle integrations smoothly.

The digital alternative to legacy systems

To survive and thrive in the new competitive manufacturing landscape and set the stage for future growth, manufacturers must implement technology designed to automate any process that can be automated. Modernizing legacy applications offers a host of benefits, including faster time to market, lower risks and increased cybersecurity, and digital competitiveness.

Companies spend billions annually on digital transformation initiatives, yet over half of B2B transactions still rely on emailing documents between parties and manually entering data into systems, for example.

This approach creates myriad problems including inaccuracies resulting from human error and slower processing times. To reap more benefits from digital automation, businesses should implement purpose-built automation platforms designed to close the automation gap for critical, complex B2B transactions. These platforms:

Create resilient operations able to scale with businesses. As businesses grow, their operational capacity no longer depends on the size of their workforces.

Reduce costs while supercharging growth, cutting operational costs by automating slow, inefficient and error prone manual processes.

Improve customer service, making it easy for customers to do business with the company by building enduring, frictionless customer and supplier relationships without requiring them to change processes on their end, too.

When manufacturing companies automate processes, they increase efficiency, accuracy and agility. Freeing employees from mundane, repetitive tasks allows sales teams, for example, to connect and build relationships with customers and resolve problems requiring critical thinking and analytical skills. Updating systems also opens room for future growth and scalability, because your operational capacity doesn’t rely on the size of your workforce.

Digital transformation also more easily handles big data. Legacy systems tend to live within their own silos. Modern solutions remove the silos and enable organizations to implement one platform companywide to manage all data used to support business decisions. New purpose-built automation platforms effortlessly:

Extract, translate and deliver complex, unstructured data into structured systems without human intervention.

Define and apply business rules, logic, lookups and data validation to accommodate the unique commercial terms in B2B relationships.

Resolve exceptions quickly with real-time alerts and user-friendly exception workflows.

Upgrading to cloud solutions offers higher levels of security and better performance, too. Cloud-hosted data is more secure from cyber attacks because the cloud can be updated easily to protect against current potential threats.

The digital revolution: Helping manufacturers stay ahead of the competition

Historically, the “if it ain’t broke, don’t fix it” mentality applied to legacy manufacturing technology due to the inconvenience and cost of implementing new solutions. That reluctance is understandable, because legacy systems are difficult to replace, modernization brings a certain level of risk, and many organizations fear the unknown.

It’s good business sense for the manufacturing industry to act now — to invest in digital transformation designed to maintain and increase process efficiency, maximize throughput and decrease expenses.

Aerostar Focuses on Safety with First Aid Certification Course

Keeping our team safe is one of our top priorities at Aerostar Manufacturing.

In support of this, we were able to provide CPR/AED First Aid Certification to our staff.

Aerostar Celebrates Employees with Summer Appreciation

Aerostar Manufacturing takes great pride in Employee Appreciation! Join us in recognizing these amazing individuals!

Wishing you the best on your birthday and the year ahead!

Gauravk Aggarwal

Nasser Ahmed

Ana Avalos

Anthony Hart

Richard Leonard

Russell Melchert

Manoj Patel

Sonal Patel

Waleed Mosed

Happy Anniversary! Thank you for your dedication to Aerostar!

Jamie Usher - 3 years

Donald Howard - 1 year

Ana Avalos - 1 year

Michael Fisher - 1 year

Mitch Wright - 17 years

Employee Referral Bonus

As an added incentive in our Employee Appreciation efforts, current Aerostar employees are eligible to earn a referral bonus of $600 if they are able to refer someone to Aerostar and they work for 180 days!

Aluminum Forging Process

According to The Aluminum Association:

"Forging is a manufacturing process where metal is pressed, pounded or squeezed under great pressure to produce high-strength parts. Forged aluminum is ideal for applications where performance and safety are critical but a lighter-weight metal is needed for speed or energy efficiency. The forged aluminum wheels on Daytona racecars are a perfect example. There are primarily three types of forging processes: open-die forging, ideal for larger aluminum components; closed-die forging, well-suited for more intricate designs and tighter tolerances; and ring-rolled forging used to create high-strength ring-shaped applications.

Take-Away Facts

High performance and strength

"The forging process is used in applications where performance and strength are critical requirements.

Forged components are commonly found at points of stress and shock. Pistons, gears and wheel spindles in high performance automobiles and aircraft are often made from forged aluminum.

Forged aluminum perfect for aerospace

"The challenging and harsh environments in space necessitate structures that are strong and durable, but also lightweight. Forged aluminum’s low density relative to steel makes it an ideal candidate for aerospace applications.

Tools of the trade

"Hammers, presses and upsetters are the basic types of equipment used in the forging process. Hammers can apply a driving force of up to 50,000 pounds where presses can exert a force of up to 50,000 tons. Upsetters are basically a press used horizontally to increases the diameter of a work piece by compressing its length.

Mark of quality

"'Forged' is the mark of quality in hand tools and hardware. Pliers, hammers, wrenches, garden implements and surgical tools are almost always produced through forging.

Aluminum Forging 101

Open-die forging

"Ideal for processing large pieces of aluminum, open die presses do not constrain the aluminum billet during the forging process and utilize flat dies free of precut profiles and designs. Aluminum blocks weighing up to 200,000 pounds and 80 feet in length can be open-die forged to create large aluminum components with optimal structural integrity. While welding and joining techniques are useful in creating large components, they cannot match the strength or durability of a forged part. Open-die forgings are limited only by the size of the starting stock.

Closed-die forging

"Closed-die forging, also known as impression-die forging, can produce an almost limitless variety of shapes that range in weight from mere ounces to more than 25 tons. As the name implies, two or more dies containing impressions are brought together as forging stock undergoes plastic deformation. Because the dies restrict metal flow, this process can yield more complex shapes and closer tolerances than open-die forging. Impression-die forging accounts for the majority of aluminum forging production.

Rolled-ring forging

"When industrial applications call for a high strength, circular cross section component, there is no match for rolled-ring forging. The process typically begins with an open-die forging to create a ring preform, shaped like a doughnut. Next, several rollers apply pressure on the preform until the desired wall thickness and height are achieved. Configurations can be flat, like a washer or feature heights of more than 80 inches. Rings can be rolled into numerous sizes, ranging from roller-bearing sleeves to large pressure vessels.

Wheels Built for Speed, Performance and Safety

"Professional racecar drivers know that forged aluminum wheels are a great choice for the punishing conditions of competitive racing. Built for speed and performance, forged wheels are extremely lightweight, very strong and exceptionally stiff. Forged aluminum wheels are found off the racetrack too. High performance sports models from Porsche, Lamborghini and Audi can all be outfitted with these sleek and high performance wheels."