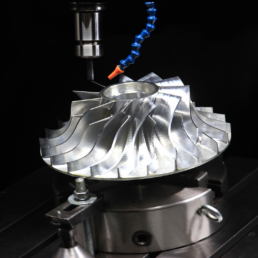

CNC Machining and CNC Education Supported by Aerostar

As explained by How Stuff Works in their article “What is CNC Machining?,” computer numerical control (CNC) machines are vital to the manufacturing process.

“A computer numerical control machine (CNC) is a machining tool that forms stock material to a desired shape that will fulfill manufacturing directives and component requirements. CNC machines use pre-programmed software to control the movements of complex machinery, including grinders, lathes, mills and other cutting tools used to remove material,” How Stuff Works said.

Click here to learn more about Aerostar’s CNC Machining capabilities or here to read the full article.

Article with all rights reserved, courtesy of How Stuff Works -------- https://www.howstuffworks.com/

.Photo with all rights reserved, courtesy of Canva -------- https://www.canva.com/

Aerostar Manufacturing Supports Global Manufacturing and Praises India’s Increased Incentives to Boost Production

Aerostar Manufacturing Supports Global Manufacturing and Praises India’s Increased Incentives to Boost Production

As reported by Yahoo Finance in their article titled “India launches $2 billion incentive package to boost IT hardware production,” India has begun to implement an incentive plan that aims to attract more investors in IT hardware manufacturing including laptops and tablets.

“The scheme is key to India’s ambitions to become a powerhouse in the global electronics supply chain,...targeting an annual output worth $300 billion by 2026,” Yahoo Finance said.

Click here to learn more about Aerostar’s Global Sourcing or here to read the full article.

Article with all rights reserved, courtesy of Yahoo Finance -------- https://finance.yahoo.com/.

Photo with all rights reserved, courtesy of Canva -------- https://www.canva.com/

More high-end iPhones being made in India, as Apple continues to reduce reliance on China

According to 9to5Mac:

More high-end iPhones are being made in India, as Apple continues to reduce its dependence on China as a manufacturing center.

Apple has begun a three-stage shift of some flagship iPhone production from Foxconn in China to Luxshare in India …

Background

The need for Apple to lessen its dependence on China as a manufacturing center has been clear for many years, but the impact of the pandemic at the world’s biggest iPhone assembly plant really underlined the problem. The COVID-19-related disruption was estimated to have cost the company a billion dollars per week.

India is seen as Apple’s main hope when it comes to relocating production outside of China. A report last year suggested that a quarter of all iPhones could be made in India by 2025, and a later one indicated that this could rise to half of all iPhones by 2027.

We learned earlier this week that Apple’s primary iPhone assembler, Foxconn, has begun construction of two new iPhone plants in India, and that new government incentives mean that iPad production is also expected to begin there soon.

More high-end iPhones being made in India

Today, a new investment note from Apple analyst Ming-Chi Kuo says that the Cupertino company is boosting Indian production of high-end iPhone models, as well as diversifying suppliers. Apple has promoted Chinese company Luxshare from a secondary supplier to a top-tier one, ranking alongside Foxconn.

First, Luxshare is now being given more iPhone orders, including those for top-end models.

Apple has transferred some iPhone 14 Pro Max orders to Luxshare for risk diversification after the Foxconn Zhengzhou incident in November 2022. Luxshare’s production yield improvement schedule for the iPhone 14 Pro Max is better than expected, so the company has been awarded the iPhone 16 Pro Max assembly NPI for 2024.

NPI stands for New Product Introduction, and means that the company is now trusted to make top-tier models during the product launch period. Previously, Luxshare has only been awarded flagship model orders some time after launch, when yield levels are less critical.

Kuo says this indicates that Apple now has full faith in Luxshare, viewing it as Foxconn’s equal.

Second, Luxshare will make iPhone 15 Plus models from launch, and later add the iPhone 15 Pro Max. This will see the company more than double its iPhone production, from around 20M units last year to 45-50M this year.

Third, in 2024, Luxshare will actually be given more prestigious orders than Foxconn for iPhone 16 production in India. Kuo says that Indian iPhone assembly orders are being split as follows:

Foxconn: iPhone 16 & iPhone 16 Pro

Luxshare: iPhone 16 Pro Max

Pegatron: iPhone 16 Plus

Apple helping Luxshare build production lines

It’s previously been suggested that Luxshare – which bought two iPhone production plants from Wistron – doesn’t have experience of navigating the political issues often involved in securing the necessary clearances for new factories. Permits are often required at local, regional, and national levels.

However, Kuo says that Apple is expected to assist Luxshare with this process.

9to5Mac’s Take

It’s no easy feat to gain Apple’s confidence in your ability to manufacture top-end iPhones during the initial run-up to launch. The fact that Luxshare has done so bodes well for the company’s future.

But it’s also good news for Apple. Having additional production capacity in India for flagship models will help reduce the risk of the supply problems the company suffered with the iPhone 14 launch, and diversifying suppliers as well as countries offers additional reassurance against production holdups.

Global firms are eyeing Asian alternatives to Chinese manufacturing

According to The Economist:

In 1987 panasonic made an adventurous bet on China. At the time the electronics giant’s home country, Japan, was a global manufacturing powerhouse and the Chinese economy was no larger than Canada’s. So when the company entered a Chinese joint venture to make cathode-ray tubes for its televisions in Beijing, eyebrows were raised. Before long other titans of consumer electronics, from Japan and elsewhere, were also piling into China to take advantage of its abundant and cheap labour. Three and a half decades on, China is the linchpin of the multitrillion-dollar consumer-electronics industry. Its exports of electronic goods and components amounted to $1trn in 2021, out of a global total of $3.3trn. These days, it takes a brave firm to avoid China.

Cisco to Manufacture in India

According to Cisco:

Cisco, a global technology leader, announced today that it will start manufacturing in India, a major step in the expansion of its footprint in the country. This move is a part of Cisco's strategy to create an even more diverse and resilient global supply chain and support India’s vision of becoming a global manufacturing hub. With this latest investment, Cisco will cater to the growing demand from customers in India and aims to drive more than $1 billion in combined domestic production and exports in the coming years.

The creation of a new manufacturing operation was announced by Cisco Chair and CEO Chuck Robbins in New Delhi, following a meeting with Prime Minister Narendra Modi, and a series of strategic engagements with Dr.S. Jaishankar, External Affairs Minister, Rajeev Chandrasekhar, Union Minister of State for Entrepreneurship, Skill Development, Electronics & Technology, B.V.R. Subrahmanyam, CEO of NITI Aayog, and K. Rajaraman, Telecom Secretary.

"Today, we are announcing strategic investments in Indian manufacturing capabilities as the next step in delivering cutting-edge technologies to our customers in India and across the globe," said Chuck Robbins, chair and CEO of Cisco. "Fueled by a rapidly developing digital economy, India is a focal point of innovation and business for Cisco, and we remain deeply committed to our partnerships here.”

As organizations in India and across the globe fast-track their digitization, their technology needs are growing and evolving rapidly. The manufacturing facility will build Cisco’s best-in-class technology, designed to provide flexible, cost-effective delivery of next-generation services and applications and support complex cloud computing environments. The products can meet companies’ dynamic demands as they strive to foster agility in an increasingly hybrid, digital-first world.

Cisco is now building core manufacturing capabilities in India, including testing, development and logistics, and expanding in-house repair operations. In addition to supporting supply chain resiliency, reducing lead times, and elevating customer experience, this will add further impetus to the local economy.

“India is of strategic importance for Cisco, and we continue to bet on India. Today's announcement marks a significant milestone to power the next phase of growth for Cisco. This investment will enable us to bring state-of-the-art technologies to more people and businesses and help accelerate India’s transition into a leading digital economy,” said Daisy Chittilapilly, President, Cisco India & SAARC.

India is a key market for Cisco and its second largest R&D center outside the US. Since commencing operations in India in 1995, Cisco has focused on helping the country digitize at scale and speed, including accelerating the transformation of critical sectors like transport, agriculture, including through the Country Digitization Acceleration program, and building a skilled workforce through the Cisco Networking Academy program.

India’s global manufacturing hub ambition gets strong investment boost

According to India Today:

India’s goal of becoming a global manufacturing hub is gathering momentum as more global companies continue to invest in the country. The flurry of investments is not only good news for the Indian economy but also for the ruling government ahead of the crucial general elections next year.

From Apple to Amazon, some of the top global companies, especially those in the US, have set their sights on India as the country expands rapidly across various sectors. Global companies are also relying on India to reduce their dependence on China, following the disruptions they faced last year.

From Apple to Amazon

On Tuesday, Amazon Inc’s cloud computing division, Amazon Web Services, became the latest company to invest in India. The company has planned to invest $13 billion (over Rs 1 lakh crore) in India by 2030 to build its cloud infrastructure and create thousands of jobs.

US technology giant Apple, the most valuable company in the world in terms of market value, recently opened its first physical retail stores in India, one in Mumbai and another in New Delhi.

Apple CEO Tim Cook personally flew down to India for the inauguration of the stores and said Apple “was committed to growing and investing across the country”.

The move is in line with Apple’s aim to make India a bigger manufacturing base after relying on China for years.

The company has started manufacturing several products in India through its contract electronics makes Foxconn, Wistron Corp and Pegatron Corp.

Speaking of contract electronic manufacturers, Taiwanese giant Foxconn is investing $500 million in India to set up a manufacturing plant in Telangana and almost $968 million in Karnataka. These investments are expected to create more than 70,000 jobs, according to government officials.

In addition, the Apple supplier also has plans to build a factory in India, focused on manufacturing AirPods, which are Apple’s wireless earphones.

US networking equipment maker Cisco Systems is another company that will begin manufacturing in India as it looks to diversify its global supply chain. It has set a target of $1 billion in production and exports from India over the next few years.

Last but not least, US retail giant Walmart also has plans to expand its business in India. Walmart CEO Doug McMillon recently met Prime Minister Narendra Modi and reiterated that the company planned exports from India worth $10 billion a year by 2027.

While these are just a few big companies that have shared their plans to make in India, several other companies from various sectors are expected to follow suit in their pursuit to grab a bigger share of India’s rapidly expanding economy.

As global uncertainty looms, here's how India's manufacturing sector can take off

According to Business Today:

Arun T. Ramchandani looks out of the window of his sparsely furnished room at L&T’s office in Powai, Mumbai and remembers the early days. He joined the organisation straight from IIT Delhi in 1984 after graduating with a degree in mechanical engineering. “Even then, there was a joy in manufacturing,” he says.

Four decades is a long time and in the context of how technology has evolved to engulf our lives within this time, it suddenly seems even longer. As Executive VP at L&T Defence, Ramchandani is in the midst of a decisive phase of the Indian manufacturing story. The pressure on China is palpable and India—from being a modest challenger a decade ago to becoming a versatile player well on its way to consolidating its position globally—has come a long way. Of course, the long and arduous journey ahead is not going to be easy, and a lot of things need to fall in place, from flawless execution to the correct strategy, to achieve the desired results.

“We never had enablers like 3D CAD (computer-aided design), or advanced CMM (coordinate measuring machine) systems. There used to be a heavy engineering and switchgear factory here, and we had to go to Tata Institute of Fundamental Research to run our programs,” narrates Ramchandani. If that is harking back to a bygone era, he is hugely chuffed about what he sees today. Just in the defence sphere, L&T today has a large spread of product offerings, among which are land-, air- and naval-based weapon systems and communications to name just a few.

Arguably, Indian manufacturing has never had it so good. There is a sense of optimism in the industry that is flush with a talented workforce and backed by the willingness of large global and domestic firms to cut the big cheques. The building blocks of creating a compelling manufacturing tale by 2047 looks good, and it is up to the stakeholders to make the most of the opportunity.

At 14 per cent of India’s GDP, manufacturing, says K.C. Jhanwar, MD of UltraTech Cement, is expected to grow by 9 per cent over the next five years. “This is distinctly much more than many other countries in Asia. We have a huge labour supply with more than half the population under 30; and in terms of cost per hour, India is at about a quarter of China (92 cents here, compared to $3.5 there). More importantly, we have a skilled labour base coupled with the second-largest English-speaking population after the US,” he points out. For international majors looking to make India a global hub, it is a seriously attractive proposition. “Of course, there is also the domestic market with a huge untapped opportunity.”

What enthuses Ramchandani is how the younger lot is looking at manufacturing now. “Some momentum was lost during the IT boom and a lot of qualified manufacturing talent preferred to go to the Middle-east,” he says. But with each phase of growth, the way in which manufacturing is perceived changes. “Now, with Industry 4.0 (the operation of machinery with tech connected through the internet), 5G and other advancements, the next few years will be hugely exciting.”

It is a sentiment shared by all stakeholders remotely linked to manufacturing. A focus on digitisation or tech is not a five- or a seven-year plan. “It needs to take place today. There are clear signals that Industrial Revolution 4.0 or 5.0 will go hand in hand with the digital and tech revolution. We will need to master the disruptions and learn to go into the future with agility and resilience,” says Vyankatesh Kulkarni, Executive Director and Head of Operations at Mercedes-Benz India. For a company that has manufacturing locations around the globe, he is well-positioned to speak on the China-plus one theme that has gained prominence recently. “There are other economies as well that offer opportunities, but India has the potential to emerge as a responsible industrial country and position itself as a competitive alternative. It is important to understand that China-plus one does not mean China-plus India,” says Kulkarni, adding, if many countries around the world have shown cyclic or segment-specific growth, India’s pace has largely remained steady and stable. He attributes the trend to investments in education and skilling, among other areas.

As much as manufacturing has the makings of a robust story, the policy initiatives introduced in recent times—such as the production-linked incentive scheme (PLI)—are just as critical. UltraTech’s Jhanwar refers to the National Logistics Policy 2022 that has a focus on reducing costs by 4 per cent of the GDP. “That will help catalyse both efficiency and scale. Already, with India’s net-zero commitment by 2070, we are seeing a shift with 40 per cent of installed capacity coming from renewable energy. Today, India is one of the global leaders in solar generation capacity,” he says.

It is the scale of ambition that will determine manufacturing in 2047. Globally, the situation is conducive for the country. Europe is in a state of flux while China is dealing with its own issues. India, meanwhile, will need to shift into top gear. Ramchandani, while pointing out the huge strategic advantage available due to our large population and demographics, says a significant improvement in the skilling process is absolutely necessary. Being in the thick of things will be a key factor.

The comparison to China or other Asian markets is inevitable. That said, the approach to India will need to be entirely different due to the range of challenges—from the level to which manufacturing has evolved in India, the complex regulatory structures surrounding land acquisition and the many more peculiar issues that crop up while setting up an enterprise in India. It boils down to how persevering one can be to get the most out of what India has to offer. Sanjeev Sharma, Country Head and MD of engineering major ABB India, who has worked across continents, speaks of some similarities between China and India’s development journey. “I was involved with China from 1994, and those who got into the country early, succeeded. There is that similarity with India and much of the same constraints; but the potential far outweighs everything else,” he says. His company has been in existence for 130 years, and in India for over a century. “We have been manufacturing for 78 years and there is absolutely no doubt that success in India comes only from having a long-term commitment.”

To him, manufacturing, regardless of the stage of development, will always provide a multiplier effect. “In India’s case, we have a low per capita income. Therefore, when you expand, there is a significant re-distribution of wealth that takes place,” says Sharma.

A growing GDP with a higher proportion from manufacturing makes for the most potent combination. “If we look at the past 8-10 years and manufacturing’s contribution to GDP, the aspiration was always to be 25 per cent or more. However, that number has always remained between 15-17 per cent,” says Soumyadeep Ganguly, Partner at McKinsey & Company. To him, the target of 25 per cent in a $5-trillion economy is achievable. For that to take place, some factors—such as strong domestic demand, the need for employment generation, growth in FDI and the export opportunities that will be available with the supply chain transformation currently underway globally, along with India’s ability to attract capital from diverse sources that complement the government’s own capex, and finally, the push for sustainability and new tech emerging thereon—are critical.

Ganguly believes there are sectors such as electronics, capital goods, chemicals and speciality chemicals, textiles and apparel, and auto and auto components that will lead India’s growth in manufacturing. “All these are well poised today. Besides, we have investments coming in here and a lot of supply chain solutions already making the shift to India,” he explains. That said, one also needs to look at the sunrise sectors among which are aerospace and defence, low carbon tech and semiconductors. He says that these upcoming sectors would be large drivers of the Indian manufacturing story. On the supply chain aspect, Jhanwar says the reconfiguration is for greater reliability and resilience.

For their part, firms think that the government’s initiatives such as Make in India and the push for electrification augur well for the country. “We launched our first luxury electric vehicle (EV) in India, which is running successfully,” claims Kulkarni. Over time, the confidence levels of those putting in the money have taken off too. “It is not just OEMs or product makers who are evolving, but India has become a hub for many global Tier I suppliers as well. A mature ecosystem with skilled manpower, cost advantage and digital prowess makes us believe that we can enhance our manufacturing footprint in India,” he says. Speaking of sustainability, his company has set a target of making its new fleet of passenger cars CO2-neutral over the entire life cycle of the vehicle by 2039.

An important aspect of manufacturing is to find ways to grow exports. In defence, for instance, domestic production is around Rs 80,000 crore, with the government wanting to increase that to Rs 1.75 lakh crore by 2025. Compare that to exports in 2014, which amounted to Rs 500 crore, and is now at Rs 15,000 crore. “By itself, that is not a large number and we are a small player with a presence across segments. A defence industrial complex is being created,” says Ramchandani. That said, he expects India to be a larger player in 2047 , and defence to account for “a healthy share of manufacturing”.

In the midst of all this, the government has a role to play too. ABB’s Sharma attempts to highlight a difference between manufacturing and everything else. “If you look at services, the progress has been tremendous, but it was driven by IT infrastructure. That is now at a high stage of maturity and India is well placed,” he explains. However, manufacturing calls for physical infrastructure and that is not something that can be glossed over. Citing cases of nations such as Mexico, Vietnam, Malaysia and, of course China, he elaborates on how the infrastructure was created much before industry came in. “That [infrastructure] could be the existence of vast tracts of land or high-quality ports. It gives industry high levels of comfort when all these are in place,” says Sharma. India will need to adapt to this template, and if that does take place, the resultant progress would be multifold. “Creating an ecosystem means suppliers are locked in, making the whole process of doing business extremely conducive.”

Since 2047 is still a quarter of a century away, there will be many things that will come to fruition along the way. India in the next two decades, Jhanwar predicts, will be a hi-tech and R&D-intensive manufacturing economy. “An extensive adoption of digitalisation, robotics and analytics would provide a multiplier effect or the key ‘productivity to prosperity’ driver,” he says. To him, the multitude of factories and machinery generating copious amounts of data is the foundation to harnessing deeper insights. “In fact, the cascading effects of policy, tech and research-based growth will lead to many SMEs making the transition to manufacturing unicorns. Technology for the future will primarily originate from the start-up ecosystem.”

Think manufacturing and go global is the credo. “We are manufacturing for the world. India is looking to exploit its digital strengths, take that to manufacturing and provide a robust alternative to China,” explains Ramchandani. He says there is little doubt that by 2047, India will have made the transition from relatively small-scale manufacturing to becoming a global manufacturing hub. Digital alone has the ability to ramp up the manufacturing sector. Enabling free-flowing access to information on the digital backbone helps in paving the way for higher productivity and transfer of knowledge. If Industry 4.0 is here, maybe, we could be seeing an Industry 7.0 in 2047. That’s how much of a profound impact digital can have, Ramchandani explains.

Looking into the future, ‘manufacturing next’ is a phrase Jhanwar picks to define an industry resilient to frequent disruptions. “It could be supply chain shocks, technology shifts, volatile energy prices, product obsolescence or innovative business models. India has access to all the key ingredients and a great foundation to become a leading player in manufacturing next,” he says, with a generous dose of hope and confidence. Our place under the manufacturing sun is just around the corner.

India ‘on cusp of change’ as global manufacturers look beyond China

According to SCMP:

- US-China rivalry is providing a tailwind, and India will be a big beneficiary as companies move toward a ‘China-plus-one’ strategy, supply chain analysts say

- Narendra Modi’s ‘Make in India’ campaign kicked off in 2014, seeking to emulate China and the tigers of East Asia – like Singapore and South Korea

India’s economic transformation is kicking into high gear.

Global manufacturers are looking beyond China, with Prime Minister Narendra Modi stepping up to seize the moment. The government is spending nearly 20 per cent of its budget this financial year on capital investments, the most in at least a decade.

Modi is closer than any predecessor to being able to claim that the nation – which may have just passed China as the world’s most populous – is finally meeting its economic potential. To get there, he’ll have to wrestle with the drawbacks of its exceptional scale: the remnants of the red tape and corruption that have slowed India’s rise, and the stark inequality that defines the democracy of 1.4 billion people.

Giving a timely push to ‘Make in India’ manufacturing

According to Bizz Buzz:

Is India on the cusp of a manufacturing boom? The Centre is hopeful that, given its potential, the country can become a global manufacturing hub, with a $500 billion volume by 2030. In 2021, it was $7747 billion. That is the hope and there are some good signs on that front. S&P Global India Manufacturing Purchasing Managers’ Index showed a three-month high in March, with the index rising to 56.4 from February’s 55.3. US technology major Apple has increased its iPhone production in India quite significantly, having made about seven per cent of them in the previous financial year. Apple partners Foxconn Technology Group and Pegatron Corp assembled its products in the country, which is a remarkable progress, considering that India manufactured just one per cent of the world’s iPhones in 2021.

Chinese smartphone maker Vivo has also announced Rs 1,100-crore investment in their new 169-acre manufacturing unit in Greater Noida. As per the recent index of industrial production (IIP), manufacturing grew 5.3 per cent in February, which is not very impressive as the base, February 2022, was very low at 0.2 per cent. However, data for the April 2022-February 2023 period showed 4.9 per cent rise, which was against 13 per cent in the corresponding period in 2021-22. Similarly, capital goods, implying capacity addition to the economy, have been doing well. The segment grew 10.5 per cent in February, but this was against a low base of 0.3 per cent in February last year. But in the first eleven months of the last fiscal, capital goods grew by a whopping 13.4 per cent, against a very high 19 per cent in the corresponding period in 2021-22, which are signs that manufacturing is in a recovery mode. Another survey conducted by Ficci shows that capacity utilization in the manufacturing sector stood at 72 per cent in the second quarter of FY22, indicating the sector’s significant recovery. More importantly, capacity utilization was 69.1 per cent in the Covid-hit Q2 in 2019-20.

India is gradually progressing on the road to Industry 4.0 through the government’s initiatives like the National Manufacturing Policy, which aims to increase the share of manufacturing in GDP to 25 per cent by 2025 and the production-linked incentive (PLI) scheme to boost the core manufacturing sector at par with global standards. All these sound nice, but the objective reality is not as cheerful. Never once since 1960 has the share of manufacturing in GDP even touched the 20 per cent mark. The high watermark was 18 per cent, which was touched in 1979 and 1995. From 16 per cent in 2015, it gradually declined to reach a low 13 per cent in 2019. It went up to 14 in 2021.

The government claims that industrialists can take advantage of four market opportunities: expanding exports, localizing imports, internal demand and contract manufacturing. With digital transformation being a crucial component in achieving an advantage in this fiercely competitive industry, technology has today sparked creativity. That’s true but the Central government should also ensure that states carry out economic reforms at their level. This is the sine qua non of rapid industrialization.

Can India become the next high-tech hub?

According to NPR:

China's dominance in global manufacturing has been well established for more than a decade, but India wants to challenge that status. Companies like Apple and Samsung are increasing their Indian suppliers amid geopolitical tension between the U.S. and China.

What would it take for India to become the factory of the world?